After the economic storm caused by the pandemic, the bonanza has arrived for Portuguese businesses which, in 2022, recorded a 33% growth in their turnover compared to 2021 thanks, to a large extent, to the recovery of the tourism sector.

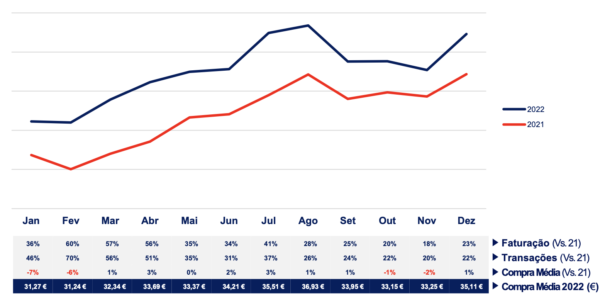

Total Turnover 2022 vs. 2021

According to the transactional report REDUNIQ Insights for last year, Portuguese businesses invoiced 33% more than in 2021, a growth fuelled and justified by the increase in foreign invoicing (+101%) and, to a lesser extent, domestic consumption (+23%).

Total Turnover 2022 vs. 2021

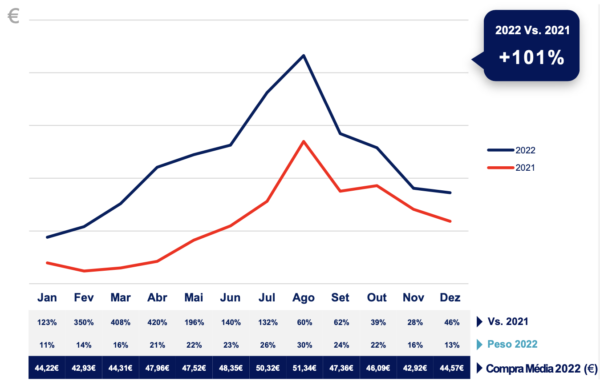

Foreign invoicing grew by 101% in 2022

With regard to foreign turnover, the report tells us that 31% of it was allocated, unsurprisingly, to the Hotel & Tourist Activities sector, 19% to Restaurants and 13% to Hyper & Supers. It should be emphasised that the summer of last year was marked by an almost total recovery (+30% compared to 2021) in tourist activity compared to the pre-pandemic period.

Foreign invoicing 2022 vs. 2021

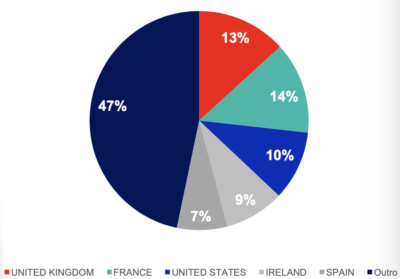

Still on the "foreign turnover" item, the biggest contributors to such positive results are French (14% of total foreign turnover), British (13%), American (10%), Irish (9%) and Spanish (7%) tourists.

Top Nationalities Foreign Billing 2022

In the case of invoicing originating from French cards, the Centre with 52.5%, the North with 45.3% and the Alentejo with 43.5% were the regions where France topped this ranking, which leads us to speculate, especially in the case of the regions north of the Mondego, that the higher invoicing may have been due to a strong return of our immigrants during the summer.

Also under the heading of the origin of foreign invoicing, we highlight the loss of relevance of the United Kingdom (by 8 pp) and the entry of Ireland into the TOP5, with the departure of Germany, compared to 2019.

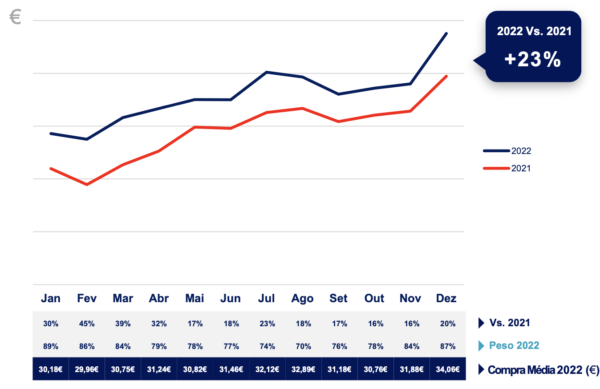

National turnover grew 23% compared to 2021

National Invoicing 2022 vs. 2021

In the case of national consumption, which, as we've seen, grew by 23% compared to 2021, the Hipers & Supers sector continues to lead with 37%, followed by Stationery Stores (bookshops, magazines and tobacco) with 13%, Petrol Stores with 11% and Fashion with 9%. With the normalisation of consumption patterns in the post-pandemic period, Hipers & Supers have lost weight, while Fuels, Restaurants and Fashion have recovered to levels close to historical levels.

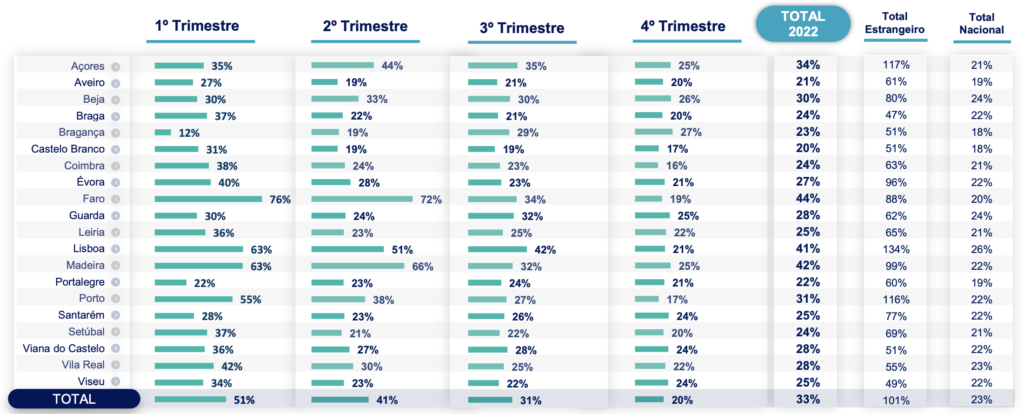

Given these results and trends, the districts that ended up recording the greatest growth were, unsurprisingly, those where the tourism sector is most significant.

According to REDUNIQ InsightsFaro topped the national turnover ranking with a turnover growth of 44% (88% growth in foreign turnover), closely followed by Madeira with a turnover increase of around 42% (99% growth in foreign turnover), Lisbon with 41% (134% growth in foreign turnover), the Azores with 34% in total (117% growth in foreign turnover) and Porto with an increase in turnover of 31% in total (116% growth in foreign turnover).

Overview by Region Year-on-Year Change in Turnover

As can be seen in the graph, Lisbon was the only district in which national consumption grew significantly (3 p.p.) above the national average, reflecting the "normalisation of a city impacted by the consolidation of teleworking models in many of its economic service activities".

It should be noted that, in terms of the average purchase in each district, Madeira and Faro have the highest figures. Under the same heading, but by sector of activity, Hotels & Tourist Activities with an average ticket (average amount spent on each purchase) of €144 has the highest value, followed by €119 in Car Accessories and Workshops and €118 in Electrical Appliances & Technology.

75% of transactions in Portugal are made using Contactless technology

O Contactless is, without a doubt, the big star on the payments scene in Portugal.

While in 2019 only 16% of transactions were made using this payment technology, by the end of last year this percentage had already reached 75%, 9% more than what was recorded in 2021.

This impressive performance by contactless necessarily ends up being reflected in the turnover of Portuguese businesses. In the period under review, the weight of contactless in business turnover totalled 56%, 10% more than in 2021 and 50% more than before the pandemic.

Contactless Billing Weight and Transaction Weight

The growth of contactless in Portugal is also visible in the average purchase price. The report tells us that

"considering an average contactless purchase of approximately €25 (naturally lower than the average value in the system), by 2022 this payment method will account for more than half of REDUNIQ's turnover."

In order to help Portuguese businesses adapt to this new type of payment and increase their sales, REDUNIQ offers a wide and diverse range of automatic payment terminals (TPA) which, in addition to the providential contactless, provide retailers with a multitude of functionalities that make their activity more mobile and digital.